A Sudden Shift: Is a New Bull Run Beginning in India’s Stock Market?

For weeks, the mood in India’s financial circles had been one of cautious waiting. Headlines were dominated by global uncertainties and the persistent selling by foreign investors. But last week, something shifted. A fresh optimism began to spread through the markets, turning cautious waiting into confident action.

The Indian equity market closed in the green for the second week in a row, but the real story wasn’t just the rising numbers. It was the return of a key group of players: Foreign Institutional Investors (FIIs). After months of being net sellers, these global investors turned net buyers, pouring a substantial ₹3,289 crore into the cash market in just four trading sessions.

This sudden change in behavior suggests that international confidence in Indian equities is rebounding, providing the stability needed for a sustained upward move. As one analyst noted, this moderation in outflows has given the broader market “much-needed stability” after a volatile period.

The Turning Point: More Than Just a Number

This FII buying is more than just a statistic; it’s a powerful signal. Think of foreign investors as guests at a party. When they start to leave, others get nervous. But when they return, and in good spirits, it often encourages everyone else to stay and enjoy the festivities. Their return last week provided a crucial vote of confidence, supporting the market against lingering global worries.

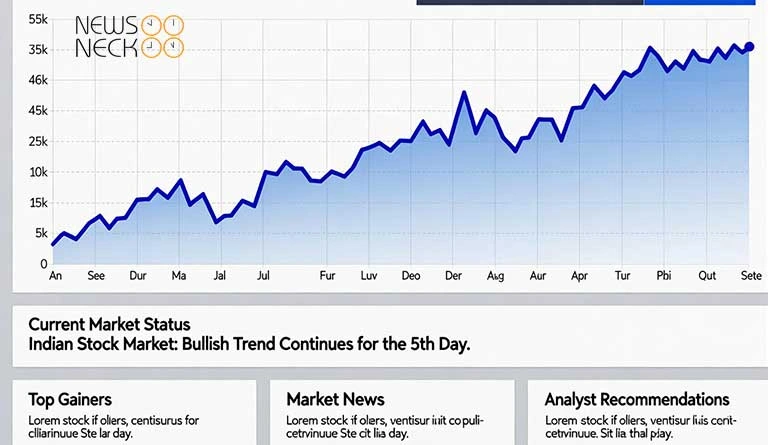

This positive shift is clearly reflected in the charts. The Nifty index, a key market benchmark, displayed strong bullish momentum, advancing 391 points over the past week and forming what technical analysts call a “cup and handle” pattern on the weekly chart . This pattern often signals the potential for further sustained upside if the breakout is confirmed by high trading volumes.

The market’s technical structure remains positive, with the Nifty trading comfortably above its key moving averages. This has led analysts to suggest that any dips in the market are likely to attract more buying interest from eager investors.

You Might Like it: All three major indexes have recently set record highs

A Week of Watchfulness: All Eyes on October 17

The coming week, however, is not expected to be a calm one. Analysts are pointing to a specific date as a potential flashpoint for volatility: Friday, October 17 . Market experts who study time-based cycles have identified this day as a key “turning point” where market momentum could shift dramatically.

Traders are advised to be especially vigilant, as intraday volatility may expand toward the weekend. Managing risk through stop losses and careful position sizing will be crucial.

For those watching the Nifty index, key levels to track are:

- Immediate Resistance: 25,322 and 25,434

- Immediate Support: 25,145 and 25,080

A decisive breakout above the resistance could signal a move toward 25,600 or even 25,850, while a break below support might trigger a test of lower levels.

The Bigger Picture: A Global Stage

This domestic momentum isn’t happening in a vacuum. Globally, a “risk-on” sentiment is taking hold, driven by the belief that the U.S. Federal Reserve has room to cut interest rates further after a softening in the labor market . Major financial institutions like BlackRock are staying “overweight” on U.S. stocks, a stance that often benefits emerging markets like India as global capital seeks growth.

Furthermore, the relentless growth of the Artificial Intelligence (AI) theme continues to power equities globally, creating a favorable backdrop for tech and growth-oriented investments.

A Story Still Unfolding

The Indian stock market, then, finds itself at a fascinating crossroads. The return of foreign buyers, combined with strong domestic participation and a constructive technical setup, has set the stage for a potential new leg of the bull run. Yet, the warning of heightened volatility around October 17 serves as a reminder that markets are never a one-way bet.

The story of this rally is still being written. The coming days will reveal whether this is the beginning of a powerful new trend or just a brief pause in a more complex market drama. For now, investors are watching, waiting to see if this newfound confidence will become the foundation for lasting growth.

Author: Yasir Khan

Date: 12 Oct, 2025

For More Updates, Visit Newsneck