The Hidden Cost of a Trade War: What Trump’s New Tariff Threat Reveals

If you want to understand American politics, you often have to look beyond its shores. The latest proof came this past Friday, when the relentless engine of Wall Street suddenly sputtered and choked. The cause was not a domestic crisis, but a familiar ghost from the recent past: the threat of a full-blown trade war with China.

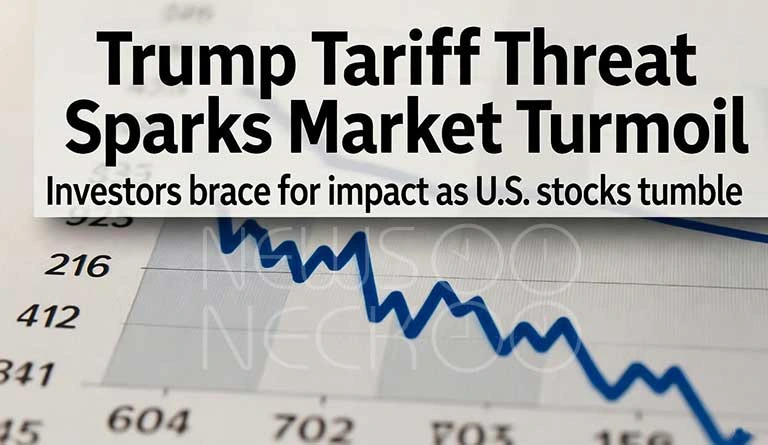

The trigger was a revival of tensions between Washington and Beijing, highlighted by a new threat from President Donald Trump to hit China with “massive” tariffs. The reaction was immediate and sharp. Wall Street recorded one of its worst days in recent memory, with the S&P 500 falling 2.7% and the tech-heavy Nasdaq Composite sinking 3.6%. The Dow Jones Industrial Average dropped nearly 900 points, a stark number that wiped out billions in wealth and cast a pall over the market’s recent enthusiasm.

This is more than a story about stocks. It is a story about the return of a political and economic strategy that pits American power against Chinese ambition, with the financial security of ordinary people caught in the middle. The sudden sell-off is a direct reaction to the fear that the fragile truce in the economic contest between the two giants is about to shatter.

A Flashback to a Recent Past

For the stock market, the threat of tariffs is a flashback to a period many investors had hoped was behind them. From 2018 to 2020, the Trump administration used tariffs as its primary weapon in a trade conflict with China, arguing it was necessary to protect American jobs and industries.

This approach created a cloud of uncertainty that often dampened market sentiment. The “trade war” led to higher costs for American companies that rely on Chinese imports, and those costs were often passed on to consumers. Just as the market had begun to move past this chapter, the threat has reemerged, sparking fears of a return to those volatile times. As one market strategist put it, this new wrinkle of “massive’ tariffs is not what the market and company executives wanted to deal with”.

More Than a Number: The Human Cost of Tariffs

It is easy to see a falling stock chart as an abstract concept. But the reality of a trade war hits much closer to home. Think of tariffs as a tax on imported goods. When the United States places a tax on products from China, it does not necessarily mean Chinese companies pay the price. Often, it is American companies that pay, and they, in turn, may raise prices for American consumers to cover their new costs.

This means that the price of everyday items from electronics and clothing to household goods could go up. This acts as a hidden tax, shrinking the purchasing power of American families at a time when many are already concerned about the cost of living. A trade war does not just affect diplomats and CEOs; its effects trickle down to the kitchen table, impacting the budget of a family buying school supplies or a small business owner trying to afford new equipment.

You Might Like it: Trump threatens 100% tariffs on China, American farmers Caught in Crossfire

A World of Uncertainty

The return of tariff threats adds another layer of worry to a market that was already navigating other challenges. A government shutdown is stretching into a new week, and a key deadline for federal pay is approaching, adding to the sense of instability. Furthermore, the shutdown has caused a blackout of important government data on the economy, leaving Wall Street to “fly blind” on the health of the U.S. recovery.

This combination of factors creates a perfect storm of uncertainty. Investors, businesses, and consumers all thrive on predictability. When the future becomes difficult to forecast, as it is with the potential for a disruptive trade conflict, the natural reaction is caution. This caution is what we see in a falling stock market it is a collective pause, a reassessment of risk, and a preparation for tougher times ahead.

A Cycle We’ve Seen Before

The rhythm of this conflict is becoming familiar. A threat is made, the market reacts with alarm, and the public braces for impact. The question is whether this cycle will lead to a serious negotiation or simply more economic damage.

The dramatic drop in the market is a powerful signal. It suggests that the financial world, which typically cheers for strong nationalistic policies, sees this particular path as a dangerous one. The fear is that this is not just a negotiating tactic, but the start of something worse for the market and for the economy.

In the end, the story of the market’s bad day is a lesson in interconnection. It shows that a political statement from a former president can ripple across the globe, affecting everything from the value of a retirement fund to the price of a child’s toy. As we watch this old conflict reignite, we are reminded that in the global economy, there are no true walls only bridges that, when threatened with collapse, make everyone less secure.

Author: Yasir Khan

Date: 12 Oct, 2025

For More Updates, Visit Newsneck