The Pendulum Swings: What the Crypto Crash Reveals About Our Financial Future

If you want to understand the modern economy, you often have to look at its edges. What happens in the center with stocks and bonds and official pronouncements is only part of the story. The real action, the truth about where we are and where we might be going, often plays out in the volatile, chaotic, and revealing world of cryptocurrency.

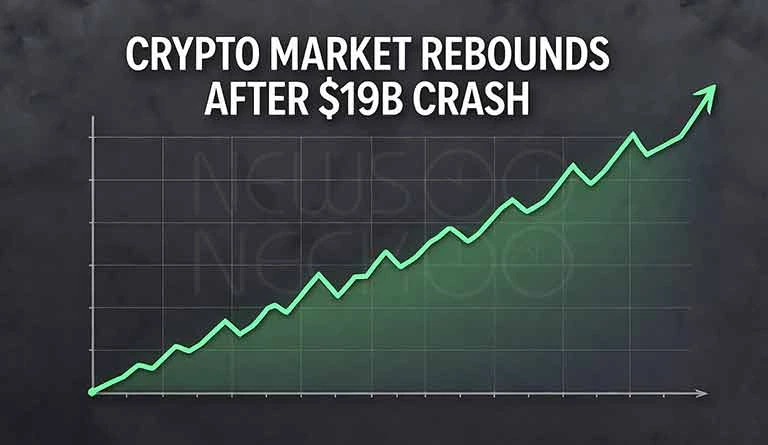

This past weekend, that world endured a shock that one report described as the largest single-day liquidation event in its history. In a matter of hours, a staggering $19 billion in futures positions was wiped out. Bitcoin, the flagship of the digital asset class, briefly plunged below $105,000. Ethereum, the second-largest cryptocurrency, plummeted to $3,300 . The air was thick with panic, and it seemed for a moment that a profound collapse was underway.

But by the start of the new week, a dramatic reversal was in motion. The market, in a display of its now-familiar volatility, staged a massive rebound. This whipsaw action from a historic crash to a significant recovery in just days. is more than a story for traders. It is a lesson in the forces that now shape our global financial system, where geopolitics, technology, and raw human emotion collide at a dizzying speed.

The Spark and the Tinderbox

The immediate trigger for the crash was a classic geopolitical event, one that would have rattled traditional markets a generation ago. The sell-off was ignited by renewed U.S. China trade tensions, specifically a shocking announcement from former President Donald Trump threatening 100% tariffs on all Chinese imports. Global markets recoiled, and the crypto market, despite its decentralized ideals, proved it is not yet an island unto itself.

This event acted like a spark in a tinderbox. The crypto market had been riding a wave of optimism, with Bitcoin recently breaking out to new heights. Such strong upward moves often create a fragile structure of leveraged bets investments made with borrowed money. When prices started to fall, these leveraged positions were automatically sold off to cover losses, a process known as liquidation. This created a cascade, amplifying a dip into a free fall. Over $1 billion in positions were liquidated in a single hour, deepening the panic.

The Uneven Landscape of Recovery

The recovery, while broad, has been a tale of two rallies. The table below captures the starkly different paths of major cryptocurrencies as they battled back from the weekend’s lows:

| Cryptocurrency | Weekend Low | Current Price (Rebound) | Key Recovery Factors |

|---|---|---|---|

| Bitcoin (BTC) | ~$104,700 | ~$115,000 (↑ ~12%) | Defended key support; institutional interest |

| Ethereum (ETH) | $3,300 | ~$4,130 (↑ ~25%) | Whale accumulation; key support at $3,800 |

| BNB (BNB) | ~$962 | ~$1,130 (↑ ~17%) | Rebound from key Fibonacci level; blue-chip status |

| Solana (SOL) | ~$174 | ~$195 (↑ ~12%) | High volatility; potential for sharp rebounds |

| Dogecoin (DOGE) | Information Missing | $0.21 (↑ ~12% in 24h) | General market recovery momentum |

As the data shows, Ethereum led the charge, with its rebound being particularly fierce. On-chain data, which records activity on the blockchain, revealed that large investors, often called “whales,” took advantage of the drop to massively accumulate ETH. In just 48 hours, a striking 230,000 ETH were withdrawn from crypto exchanges, a strong signal that big players were moving their holdings into cold storage in anticipation of higher prices, not selling in a panic.

You Might Like it: SpaceX Secures $714 Million

A System Under Stress, and Showing Resilience

This entire episode the crash and the recovery serves as a stress test for the digital asset class. It reveals several key truths. First, for all the talk of decentralization, cryptocurrencies remain deeply connected to the tides of traditional finance and geopolitics. A political announcement in Washington can still trigger a multi-billion dollar liquidation in the digital space.

Second, the market is maturing, albeit in its own unique way. The rapid rebound, driven in part by institutional capital flowing into investment products, suggests a level of confidence that was absent in previous crypto winters . Investors are increasingly willing to “buy the dip,” seeing sharp declines as opportunities rather than catastrophes.

Yet, the risks inherent in this system are profound. The very structure of leveraged trading almost guarantees that periods of calm will be punctured by sudden, violent crashes. For every trader who made a fortune shorting the market, like the one who placed a $30 million bet against Ethereum, there are countless others who were wiped out.

The pendulum has swung from extreme fear back toward a fragile optimism. The market has reclaimed lost ground, but the memory of the crash lingers. It is a reminder that in this new financial frontier, the future is not a straight line, but a volatile chart, where the lessons of a weekend can be erased by the rally of a Monday, only to be learned again another day.

Author: Yasir Khan

Date: 13 Oct, 2025

For More Updates, Visit Newsneck

One Comment

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.