Nvidia Breaks Records: The Race to $5 Trillion Explained

When Nvidia’s stock started climbing on Wednesday morning, something extraordinary happened that nobody in the financial world had ever seen before. The chip giant’s shares surged past 3%, pushing its total market value beyond the $5 trillion mark making it the first company in human history to reach that astronomical figure. To put that in perspective, Nvidia is now worth more than the entire economies of all but a handful of countries.

The Announcements That Changed Everything

The timing of this milestone wasn’t accidental. Just hours earlier, CEO Jensen Huang had dropped some bombshell announcements that sent investors into a frenzy. Here’s what sparked the rally:

Major Contract Wins:

- $500 billion worth of AI chip orders secured across various clients

- Seven dedicated supercomputers planned exclusively for U.S. government use

- Multiple deals spanning defense, research, and commercial applications

Domestic Manufacturing Push:

- Blackwell AI processors now being produced in Arizona facilities

- Major construction underway in Texas and Virginia for expanded production

- Strategic focus on keeping critical technology on American soil

Michael Brown from Pepperstone captured the mood perfectly when he observed that everything that could possibly go right for Nvidia seemed to align in just 24 hours. That’s not hyperbole it really was a perfect storm of positive developments.

How Fast Is Too Fast?

Here’s where things get really wild. Nvidia only crossed the $4 trillion valuation threshold back in July less than four months ago. Think about that for a moment. The company added a trillion dollars in value in roughly the time it takes most people to finish a semester of college.

To understand just how unprecedented this growth is, consider these numbers:

Nvidia’s 2025 Performance:

- Shares have rocketed nearly 90% since January

- Single largest contributor to S&P 500 gains this year

- Responsible for carrying much of the broader market’s momentum

- Transformed from graphics card maker to AI infrastructure kingpin

The journey reads like something from a business school case study. A company that most people only knew for making video game graphics cards has become the backbone of the entire artificial intelligence revolution.

You Might Like it: Oracle Backs AMD in New AI Chip War:

Also Read This: Meta, Blackrock Spending Billions in AI Race

The Tech Giants Battle for Supremacy

Nvidia isn’t sitting alone at the top. The competition has gotten intense, with tech’s biggest names jockeying for position in what’s becoming a historic corporate race.

The Current Standings:

- Apple recently crossed $4 trillion, boosted by strong iPhone 17 sales

- Microsoft also breached $4 trillion after valuing its OpenAI stake at $135 billion

- Nvidia has leapfrogged past Apple, Microsoft, and Alphabet in recent months

- The rankings change almost weekly as these companies trade positions

What makes this particularly fascinating is how different their paths have been. Apple sells consumer devices. Microsoft offers software and cloud services. Nvidia makes the chips that power AI. Yet all three are now clustered together at valuations that seemed impossible just years ago.

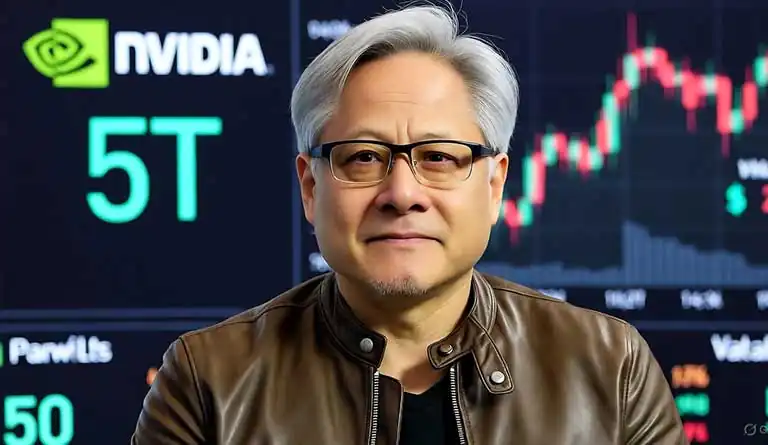

The Man in the Leather Jacket

Jensen Huang has become one of tech’s most recognizable figures, and his recent moves show he’s thinking bigger than just selling chips. At a conference in Washington, D.C., Huang revealed plans for domestic chip production and outlined an ambitious vision for American technological independence.

But he’s not just focused on AI processors. Nvidia announced a $1 billion investment in Nokia to develop 6G wireless and mobile AI technology, taking a stake in the telecom company. Huang framed this as a national security issue, arguing that America can’t afford to rely on foreign companies for next-generation wireless networks.

The geopolitical angle matters more than you might think. Huang acknowledged that Nvidia currently has zero market share in China after being effectively blocked from that massive market. However, if trade negotiations between Washington and Beijing improve, that could change dramatically.

Warning Signs Nobody Wants to Hear

Not everyone is popping champagne over these valuations. The International Monetary Fund and Bank of England issued warnings earlier this month about potential trouble in global stock markets if enthusiasm for AI suddenly cools.

The concerns are legitimate:

Market Concentration Risks:

- The current rally is unusually narrow, with gains concentrated in just a few tech giants

- Smaller companies and cyclical sectors have lagged far behind

- One stumble by Nvidia or its peers could drag down the entire market

- Historical parallels to previous tech bubbles make some analysts nervous

Even Cathie Wood from Ark Invest, who’s typically bullish on technology, suggested a reality check might be coming for AI valuations. She stopped short of calling it a bubble, but the implication was clear things might be getting ahead of themselves.

Competition Heating Up

Nvidia’s dominance isn’t guaranteed forever. Other players are making serious moves to grab a piece of the AI chip market:

Rising Challengers:

- AMD has locked in major contracts with OpenAI and Oracle.

- Qualcomm is jumping into the AI data center market with its own accelerator chips.

- Startups backed by billions in venture capital are developing next-generation alternatives.

- Big tech companies like Google and Amazon are designing their own custom AI chips.

Tech stocks broadly have been climbing, with gains spreading across the sector and pushing major indexes to record levels. That’s good news for Nvidia in the short term a rising tide lifts all boats. But it also means competitors have resources and momentum to challenge Nvidia’s position.

What Wall Street Thinks

Despite the concerns about overvaluation, most analysts remain optimistic. Barclays analyst Tom O’Malley kept his buy rating on Nvidia shares with a price target of $240, suggesting the stock could climb even higher from these already historic levels.

That confidence reflects something fundamental: demand for AI infrastructure isn’t slowing down. Every company, government, and institution trying to build AI capabilities needs the kind of chips Nvidia makes. Until that changes or until competitors offer genuinely better alternatives Nvidia’s position looks secure.

What This Means for Regular Investors

If you’re watching this from the sidelines wondering what it all means, here’s the reality. Nvidia’s performance has been so dominant that it’s essentially carried the S&P 500 this year. If you have a retirement account or index fund, you’ve probably benefited from Nvidia’s rise whether you realized it or not.

But that concentration is also the risk. When one company becomes this important to overall market performance, its problems become everyone’s problems. If Nvidia stumbles whether from competition, slowing demand, or just profit-taking by investors it could trigger broader market turbulence.

The Trillion-Dollar Question

So what happens if Nvidia officially closes above $5 trillion? Beyond bragging rights, it marks a genuine shift in how we understand corporate value in the age of artificial intelligence.

A company that makes the infrastructure powering AI is now worth more than almost any other human enterprise in history. That tells you something about where the world is heading and what we collectively believe matters most for the future.

For context, when oil was the most critical resource for the global economy, energy companies dominated market valuations. When consumer spending drove growth, retail and consumer goods companies topped the charts. Now, in an era where AI seems poised to reshape everything, the companies making AI possible command unprecedented valuations.

Whether that’s justified or excessive depends on whether AI lives up to its enormous hype. Billions of dollars are betting it will. But as those warnings from the IMF and Bank of England remind us, markets have been wrong before.

Looking Forward

The next few months will be telling. Can Nvidia maintain this momentum? Will those massive government contracts materialize as promised? Can the company successfully navigate increasing competition while expanding production and defending its technological lead?

For now, Jensen Huang and his team have pulled off something remarkable. The company has vaulted past tech giants that seemed untouchable and established itself as the indispensable player in the most important technology race of our generation.

Whether you’re an investor, a tech enthusiast, or just someone trying to understand where the world is headed, Nvidia’s rise to $5 trillion is worth paying attention to. It’s not just about one company’s success it’s about which technologies and capabilities we collectively believe will define the next decade.

And right now, the smart money says artificial intelligence is that technology, with Nvidia holding the keys to the kingdom.

Author: Yasir Khan

Date: 29 Oct, 2025

For More Updates, Visit Newsneck